The 5 key KPIs to manage the performance of your payments

In the ultra-competitive world of e-commerce, every detail counts. Although purchasing paths are refined to the pixel and acquisition strategies refined, the payment stage is all too often a blind spot in the thinking of e-retailers. However, when properly controlled, payment becomes a powerful lever for increasing turnover, reducing costs and improving the customer experience.

Nearly 70% of cards are abandoned. Among the reasons given: doubt about the security of the payment, the preferred payment method not available, a declined card, or a payment process that was too long or complex. This clearly the direct impact illustrates that a poor checkout experience can have on your conversion rate.

The key to turning the tide? Data-based management. Your payment data is a gold mine for understanding your customers and optimizing your performance. Following the right indicators allows you to adjust, test, and improve your payment strategy on an ongoing basis.

Discover the 5 key indicators to watch to turn your payment into a real growth engine.

Understanding and monitoring these indicators is fundamental for an effective payment strategy:

Definition : It is the proportion of users who complete a purchase (with a successful payment) compared to the total number of visitors to your site. It is the macro indicator of the effectiveness of your entire sales funnel.

Why it is crucial: It measures the overall effectiveness of your e-commerce, from visitor attraction to order confirmation. It is the ultimate reflection of your commercial success.

Definition: Specific to payment, it is the number of customer journeys with a successful payment compared to the number of customer journeys who visited the payment page. It is an essential indicator to assess the performance of the final stage of the tunnel.

Why it is crucial: Unlike the overall conversion rate often followed by the merchant, this KPI focuses on the efficiency of the payment phase itself. It helps identify if friction, payment options, or security are bottlenecks at the most critical moment of the purchase.

Definition: It represents the portion of payments authorized by banks or PSPs, out of all payment attempts made.

Why it is crucial: It is a direct lever on your turnover. The higher this rate, the fewer validated sales you lose. Improving technical performance has a direct impact on this rate and, therefore, on your revenue. Earning one or two points can represent several thousand euros.

Definition: It is the proportion of users who leave the process after having validated their basket but before finalizing the payment. It is the opposite of the acceptance rate to a certain extent, and linked to potential friction.

Why it is crucial: In 2024, 22% of users abandon their shopping cart because the payment process is too long or too complex. This rate reveals user experience problems, perceived mistrust, or an inadequate choice of payment methods. Monitoring it helps identify bottlenecks on the payment page.

Definition: It concerns transactions initially accepted, but contested or rejected later (fraud, failed withdrawals, etc.).

Why it is crucial: This KPI is essential to monitor your financial risk. It allows you to adjust your anti-fraud rules without stopping the conversion. A high rate may indicate vulnerabilities or a lack of appropriate strategies.

Payment data allows you to understand your customers and optimize your performance. Monitoring these key indicators is not enough; you need to analyze them to adjust, test, and improve your payment strategy on an ongoing basis.

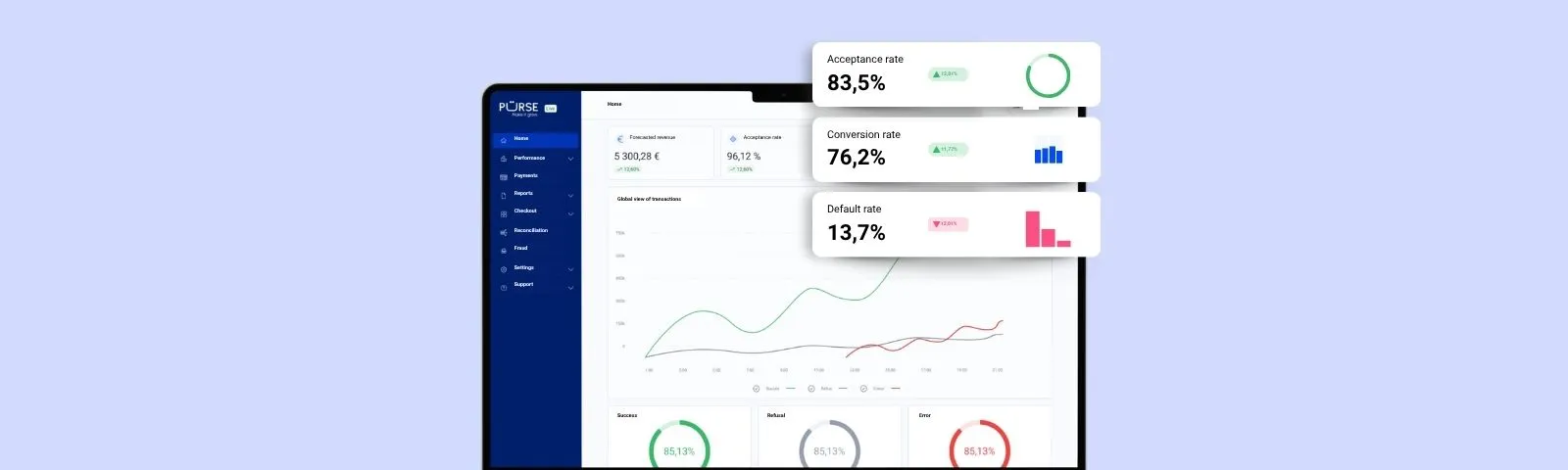

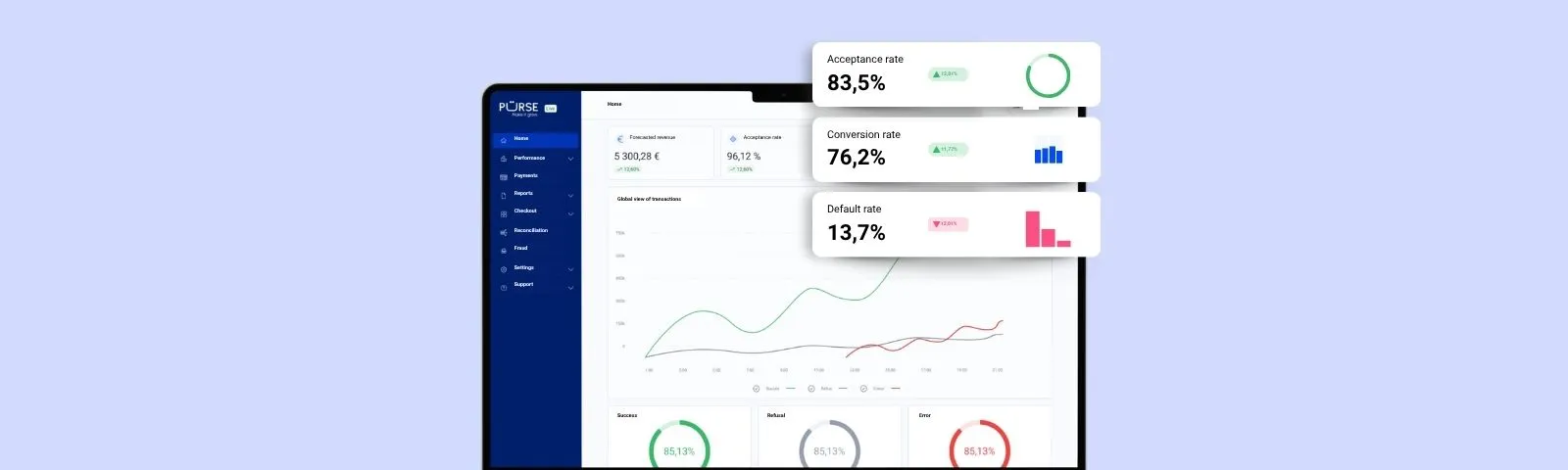

Tools like Purse dashboard Allow you to access a centralized view of these indicators, and to follow their evolution in real time.

A powerful dashboard allows you to analyze in detail the causes of failures and to monitor their evolution, thus allowing precise adjustments.

Each customer benefits from personalized support to refine the settings and optimize their acceptance rate.

(Image: Purse Dashboard)

Turning these insights into concrete actions is the last step in boosting your conversion.

Reduce friction by avoiding unnecessary fields, by allowing validation without mandatory account creation, and by activating one-click payment for already identified customers.

Study local habits and suggest the methods preferred by your customers (BNPL, wallets, gift cards, country-specific methods). A lack of choice can lead to 13% of dropouts.

Electronic wallets (PayPal, Apple Pay, Google Pay) drastically simplify the payment stage by avoiding manual data entry. 41% of online payments in France will go through electronic wallets in 2027.

The BNPL Is a reflex for many consumers, especially for medium or large sneakers. It can increase the average basket by 35%.

A secure environment is the first decision factor for the consumer. 25% of abandonments are due to a lack of confidence in security. Display trust signals (bank logos, PCI DSS, HTTPS), take care of ergonomics, and adjust security rules (e.g.: 3D Secure adapted to the amounts).

A failed payment is not a lost sale. By analyzing the cause of the failure in real time, you can redisplay the page, suggest an alternative payment method, or automatically switch to another PSP.

Optimization is a continuous process. Test different payment experiences (display, MOP order, PSPs) to identify the best performing solutions and adjust your settings live.

It is the strategic lever. Orchestration gives you back control of your payment ecosystem, without technical complexity. It offers flexibility, agility, visibility and security.

Payment is not a simple “validate” button at the end of the process; it is a crucial strategic lever for your e-commerce. Managing your payment performance using the right indicators and adopting a proactive approach is essential to reduce abandonments, increase your conversion rates and optimize your turnover.

At Purse, we support online retailers who want to make payment a driver of performance, growth and customer satisfaction. Our agnostic solution connected to more than 80 international payment methods maximizes transaction conversion while simplifying the technical architecture of our customers.

Do not wait any longer! Contact our experts to transform your payment data into concrete actions and boost your performance.