Payment page or embedded payment: the guide to choosing your approach

22% of cart abandonments are linked to a checkout process that is too complex. Almost a quarter of your potential sales are going up! What if the solution was found in the choice between embedded payment and redirection? Find out how to optimize your purchase funnel so you don't let your customers pass by.

Taking the time to think about optimizing your payment journey is strategic. Every detail counts. Even the smallest amount of friction can lead to the loss of a sale.

Through this article, we will look at the issue of integrating payment into your purchase funnel by comparing two ways of doing things: the payment page hosted by your payment provider or the integration embedded in your site.

Imagine a shopping journey so smooth that your customers only think about one thing: validate their basket. The secret? Optimized payment integration. Dive into the heart of the debate between embedded payment and redirection with us to offer a frictionless experience and boost your conversions according to your context and the expected user experience.

Embedded Payment, also called Embedded Payment, consists in integrating the payment module directly into the pages of your merchant site, creating a completely fluid experience for the user. The customer stays on your site, in a familiar environment, from the beginning to the end of their transaction, without any break in their journey.

Why it's effective for conversion

The customer never leaves your environment. It remains immersed in your codes, your colors, your charter. This visual continuity reinforces reassurance and promotes trust. — two key elements to reduce cart abandonment and improve conversion.

You maintain total control over the display of the payment module in your journey. The experience is customizable: design, positioning, wording... everything can be adapted to your brand image.

For the user, it is the least disruptive experience: they do not leave your site, they remain in an environment of trust until the last click.

Contrary to popular belief, embedded solutions are now simple to deploy.

Despite a relative impression of full integration into your site, the card entry fields are actually hosted by the payment service provider (PSP): no sensitive data transits through your site, and you remain 100% compliant with security standards (PCI DSS).

Purse offers you two options to seamlessly integrate payment into your purchase funnel:

📌 To find out more about these integration methods, you can consult our dedicated article.

Your customers are sent to a hosted payment page, fully managed by your payment service provider, as offered by Purse and its hosted. page.

This is a classic approach, often referred to as “legacy”, widely used, to which consumers are fully aware.

One of the main benefits of redirecting is Its Simplicity of Integration.

It is the easiest solution to set up, ideal if you need to quickly launch an operational payment tunnel.

In practice, the implementation is simple:

It is an ideal solution if you have limited technical resources or a need to go online quickly, without compromising on brand image.

Payment by redirection is not limited to the classic e-commerce tunnel.

It adapts perfectly to Off-site or multi-channel uses, thanks to features like the Pay by Link.

Concretely, you generate a secure and personalized payment link to the context of the transaction, to be sent by email, SMS or WhatsApp.

The customer clicks, accesses a hosted payment page, and finalizes the transaction in seconds — regardless of the device used.

This approach is particularly useful in the following cases:

Unlike embedded payment, redirection creates a short break in the purchase process. The customer leaves the site briefly to finalize the payment.

However, this interruption can be compensated by a perfectly optimized payment page:

The dedicated and secure environment can even strengthen the trust of some users, who are particularly sensitive to online payment security issues.

On mobile, the impact of the integration method (embedded or redirection) becomes secondary in the face of a more decisive challenge: the fluidity and speed of payment.

Here, what really matters is the choice of payment methods with one objective: to reduce sources of friction as much as possible, in particular manual card number entry and 3DS authentication.

To offer a smooth and effortless journey to your users, you can capitalize on two essential levers:

Apple Pay, Google Pay or other digital wallet... These solutions allow payment in one click, simple and immediate. They significantly reduce friction, regardless of the integration method used.

This feature allows your regular customers to pay more quickly and feel recognized with every order.

Whether embedded or redirected, an efficient mobile payment process is based above all onergonomics, speed and simplicity.

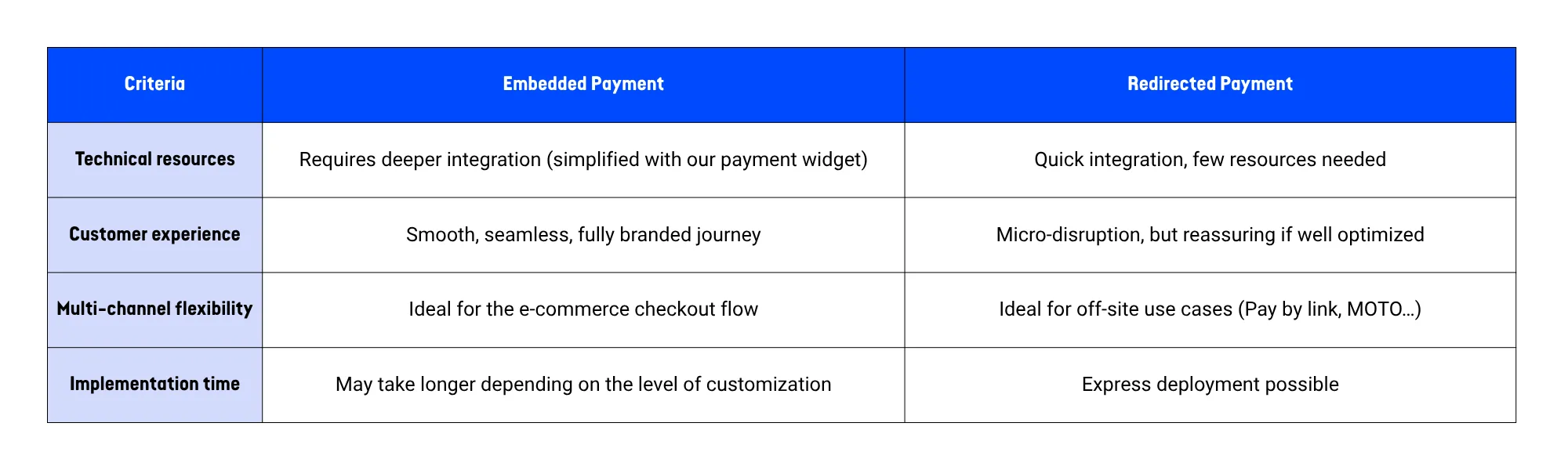

The decision between embedded payment and redirection must be based on a detailed analysis of your situation. There is no one-size-fits-all solution: the right choice depends on your specific constraints, goals and customer journeys.

Here are the main criteria to consider:

Embedded payment requires greater integration, even if modern widgets (like those offered by Purse) simplify implementation considerably.

👉 If your technical teams are small or if you need rapid deployment, the redirection Can be established as a pragmatic solution.

If your priority is to offer a smooth, continuous customer experience that is in line with your brand image, payment Embarked Is all indicated.

👉 It reinforces reinsurance, limits breakdowns and is a natural part of an optimized process.

Are you a multi-channel company? Do you manage payments via a call center, collection campaigns or distance sales?

👉 Tea redirection with Pay by Link offers you valuable flexibility to cover these specific uses.

If you sell internationally, payment Embarked Can be more reassuring for your customers.

👉 The user does not always recognize the PSP or the local bank displayed on a hosted page. On the other hand, seeing your visual universe throughout the tunnel builds trust, even abroad.

Rather than opposing embedded payment and redirection, it is more relevant to consider them as two complementary approaches, to be mobilized according to your objectives and your constraints.

With Purse, you can activate both integration modes and test their effectiveness according to channels, uses or customer profiles.

Thanks to AB testing, you can identify the mode that best maximizes your conversion rate.

Adopting a flexible payment strategy driven by your data means aligning your journey with your business challenges while meeting the expectations of your users.

In short, the best payment method is the one that corresponds to your technical constraints, your business objectives and the expectations of your customers. In an environment where every conversion point counts, this flexibility becomes a decisive competitive advantage.

Do you want to assess your options and optimize your payment tunnel? Let's talk about it.

https://purse.eu/fr/blog/headless-checkout-ecommerce-performance https://support.stripe.com/questions/embedded-checkout-vs-stripe-hosted-checkout?locale=fr-CA